PRULove Wealth Direct online insurance offers guaranteed returns and life protection in one single-pay plan

Pru Life UK has launched PRULove Wealth Direct, the first single-pay traditional endowment life insurance that can be purchased entirely online. The new product reflects the company’s push to simplify financial protection for Filipinos while providing both income growth and insurance coverage.

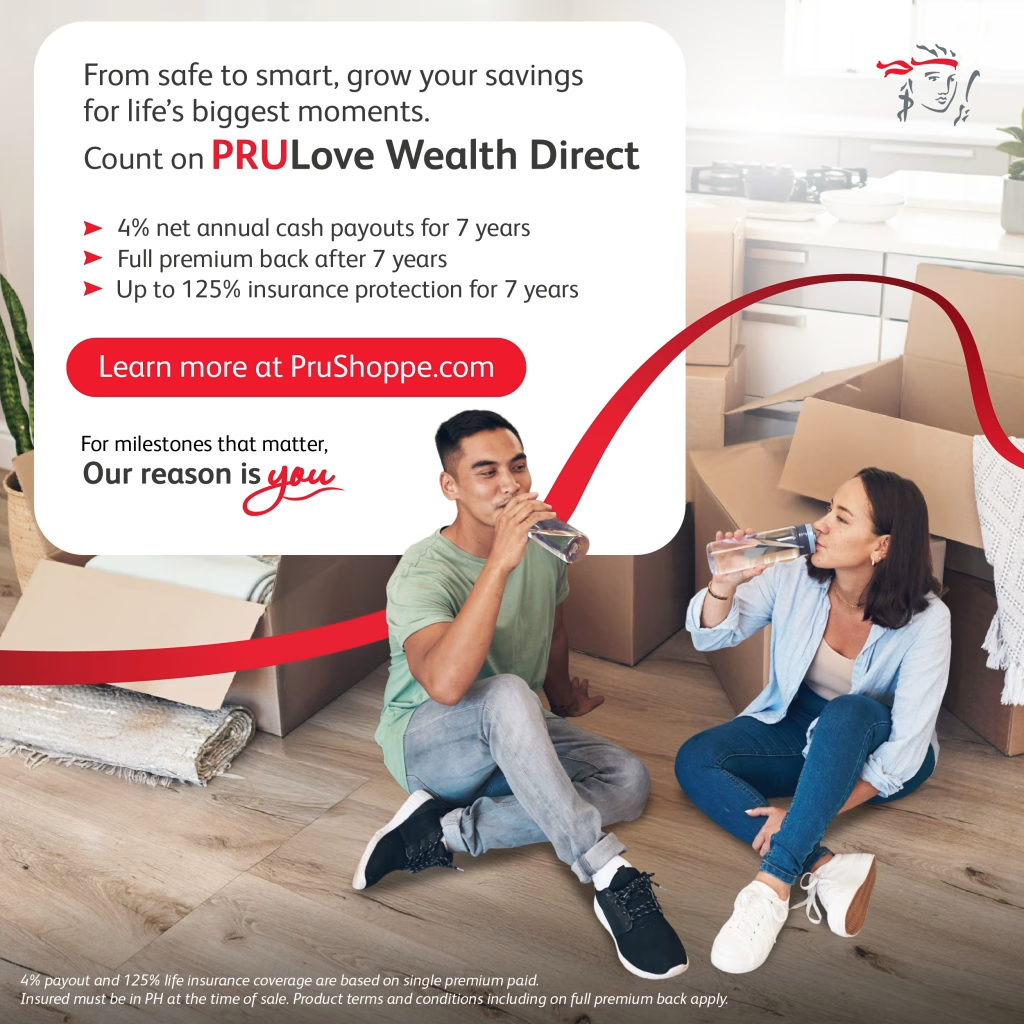

Available only through PRUShoppe.com, PRULove Wealth Direct removes the barriers that often make life insurance intimidating. There are no medical exams, no paperwork, and no long processes. With just a few clicks, customers can complete their purchase and start growing their money.

The plan offers guaranteed annual cash payouts of 4% of the single premium for seven years. At the end of the term, policyholders will get back their full premium plus life coverage equal to 125% of their initial payment. This means that clients can earn consistent returns while keeping protection for their loved ones.

Policyholders can also borrow against the policy’s cash value if they need funds for emergencies or important goals.

“PRULove Wealth Direct opens doors for people who want to secure their future but have limited time or access to traditional financial channels,” said Garen Dee, Chief Product Officer at Pru Life UK. “It provides a simple, digital way to start saving and protecting one’s family.”

With interest rates fluctuating, the product gives customers a stable alternative to time deposits. It guarantees payouts while offering peace of mind through life insurance.

This launch highlights Pru Life UK’s role in driving digital transformation in the insurance industry. As Filipinos increasingly turn to online platforms for financial products, the company continues to build tools that combine growth, access, and protection—helping every individual prepare for every future.

Learn more at PRUShoppe.com.